Accident Insurance vs. Disability Insurance – What’s the Difference?

Could you handle the financial impact of a serious injury? Many people couldn’t, which is why insurance coverage is so vital. You have two options to choose from that can help with the extra costs associated with injuries: accident insurance vs. disability insurance. However, these two types of insurance products are not interchangeable. Understanding the differences is important to avoid picking the wrong policy for your needs.

Health Insurance Isn’t Always Enough

In the U.S., most people have health insurance, whether it’s job-based coverage, a policy they purchased on their own, or a public program like Medicare. According to the U.S. Census Bureau, 91.4% of people had health insurance in 2020.

Unfortunately, health insurance alone isn’t always enough. Most plans include out-of-pocket costs like copays and deductibles. If you go out of network, you could be hit with even more costs. Depending on your plan, these may add up to hundreds or even thousands of dollars.

KFF says the average deductible for individual coverage was $2,004 in 2021, but a Bankrate report says 56% of Americans don’t have enough savings to afford a $1,000 emergency expense. In other words, many people simply don’t have enough cash to cover unexpected medical bills.

Plus, it gets worse. An injury often means you’ll need to take time off work. The U.S. Bureau of Labor Statics says private industry workers with paid sick leave have an average of just eight paid sick days. That may be insufficient to recover from a serious injury. Worse, some workers don’t have access to any paid sick days at all. The resulting loss of income can make a bad financial situation worse.

Workers’ compensation may provide coverage, but only if the injury is work related. Without additional insurance coverage, many people will be in a tight financial spot after an injury. Both accident insurance and disability insurance can provide relief.

What Is Accident Insurance?

Accident insurance is a type of fixed indemnity insurance that pays a benefit if the policyholder experiences a qualifying injury. This could be a broken bone or a burn, for example. It may also cover other injuries that require emergency room visits, such as head injuries. Policyholders often use accident insurance to cover the various medical bills health insurance does not cover, although it may be possible to use the funds in other ways.

What Is Disability Insurance?

Individual disability insurance is also called paycheck protection or income protection because it protects the policyholder’s income. If the policyholder experiences a qualifying disability and cannot work, the policy pays a benefit to replace a portion of the policyholder’s pre-disability income. Policyholders can use the benefit to cover rent or mortgage payments, groceries, bills, and other expenses. They can also use the benefit to cover medical bills.

How Do Accident Insurance and Disability Insurance Differ?

Although disability insurance and accident insurance can both provide a payout after any injury, the similarities end there.

Some important ways accident insurance and disability insurance differ include:

- Qualifying Events: Accident insurance typically covers injuries caused by accidents, such as broken bones and burns. It does not cover illness. (A separate type of insurance called critical illness insurance provides coverage for serious illnesses.) Disability insurance covers any illnesses and injuries that prevent the policyholder from working.

- Waiting Period: Accident insurance does not have a waiting period, meaning policyholders who are eligible for benefits can receive funds fast. Disability insurance does have a waiting period, with the length varying from policy to policy. For short-term disability insurance, this is often around a month. Long-term disability insurance often has a waiting period of around 90 days.

- Benefit Payment: Accident insurance typically provides a lump sum payment to provide immediate financial relief. However, it may not help with long-term issues. Disability insurance provides monthly benefits during the benefit period. During this time, policyholders can continue to receive benefits, provided they still meet the eligibility criteria. Short-term disability insurance often has benefit periods of around three to six months, although some policies provide benefits for up to a year. Long-term disability insurance has longer benefit periods, with some continuing to pay benefits until the policyholder reaches retirement age.

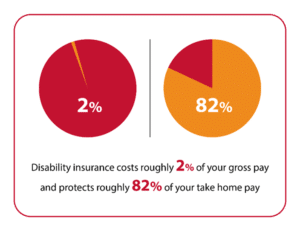

Benefit Amount: The size of the benefit varies depending on the policy. Accident insurance may pay different benefit amounts depending on the nature of the injury – with smaller benefits for less severe injuries and larger benefits for more serious injuries. For example, the payout for a very severe injury may be around $10,000 to $20,000. Disability insurance replaces a portion of the person’s income, often around 60%, of gross income or 82% of your take home pay. Those whose benefits at work are limited can secure additional coverage by buying a supplemental disability insurance plan.

Benefit Amount: The size of the benefit varies depending on the policy. Accident insurance may pay different benefit amounts depending on the nature of the injury – with smaller benefits for less severe injuries and larger benefits for more serious injuries. For example, the payout for a very severe injury may be around $10,000 to $20,000. Disability insurance replaces a portion of the person’s income, often around 60%, of gross income or 82% of your take home pay. Those whose benefits at work are limited can secure additional coverage by buying a supplemental disability insurance plan.

Which Type of Insurance Should You Buy?

Since individual needs vary, people need to decide which products make sense for them. It’s also not a matter of either/or – you can have both accident insurance AND disability insurance.

The bottom line is accident insurance can provide fast funds to cover immediate expenses. If you don’t have any emergency savings, this could be helpful. However, if you need robust paycheck protection, disability insurance is the right solution for you.

Accident insurance leaves many gaps. For example, it doesn’t cover illnesses. According to the Council for Disability Awareness, accidents are not the typical cause of disability claims: back problems and illnesses like cancer and heart disease are. If you only have accident coverage, you won’t have the insurance you need to support your finances during a serious illness.

Also, whereas the fast lump sum payout accident insurance provides can be appealing, you may receive much more from disability insurance in the long run.

For example, imagine you experience a head injury that leaves you in a coma for several days, results in permanent disability, and renders you unable to work.

- Under your accident policy, let’s say you’re eligible for a one-time payment of $10,000. That provides immediate relief. After you use it to cover your out-of-pocket medical costs, you have some left over. However, since you’re not earning a paycheck anymore, you quickly burn through the rest of the payout as well as your emergency savings. Now you don’t know what to do.

- With disability insurance, the situation would be different. Of course, you’d need a way to cover costs during the waiting period, such as through emergency savings. Then, you’ll start receiving benefits, which may continue for years – depending on your benefit period. These payments really add up. For example, if you’re receiving a benefit amount of $5,000 for a benefit period of 10 years, that’s $600,000.

When it comes to accident insurance vs. disability insurance, there’s simply no comparison. Accident insurance can be relatively inexpensive, but that’s because you won’t receive the same level of coverage. For anyone who depends on a paycheck, disability insurance provides important paycheck protection.

Are you looking for disability insurance? Request help from a licensed agent here.