Business owners are one of the top markets for selling disability insurance. While traditional W-2 employees may have their employer and/or the government providing a safety net in the event of a disability, self-employed individuals often have neither. That is, unless, you can offer help.

Business owners are one of the top markets for selling disability insurance. While traditional W-2 employees may have their employer and/or the government providing a safety net in the event of a disability, self-employed individuals often have neither. That is, unless, you can offer help.

Below you’ll find an overview of the products available and made specifically for business owners, as well as potential opportunities to help close the sale.

Products:

Business Overhead Expense

While protecting the income of small business owners is certainly important, it’s equally important to look one step further. What would happen to the source of all their income should they become disabled for an extended period of time? Would the business be able to survive for six months to a year if the owner could not work? Expenses like rent, utilities, employee salaries, and many others keep pouring in – even if the owner is not there to run the day-to-day operations.

Businesses are often referred to as the “goose that lays the golden egg” and for good reason. Even if the owner’s income is protected, there is no guarantee the business would survive their absence. Business Overhead Expense (BOE) coverage reimburses business owners for certain expenses incurred while they suffer a disability, giving them valuable time to determine if they will be able to return to their business. This can help keep the business finances strong during an uncertain time.

Disability Buy-Sell

Think about what would happen to your client’s business if one of the working owners was unable to work. How long would one owner be able to pull the weight of two people?

Most business owners with partners are familiar with a buy-sell agreement in the event of death. What about a living death? The possibility of becoming disabled for an extended period of time is far greater than the risk of death in your working years, but often times business owners are only protected by life insurance.

Buy-Sell plans fund the purchase of an employee’s share of the company, should they become unable to work due to an injury or illness for an extended period of time. If one partner is disabled for at least a year, this type of policy will help the non-disabled partner (or partners) buy them out. This is the best way to secure peace of mind for everyone involved.

Key Person

Many small businesses depend on one or a few individuals who are vital to the business, especially in highly-skilled professions that require years of training. For example: physicians, attorneys, and veterinarians (among others) often have practices with only a few main income generators. What would happen to a practice with two attorneys if one of them had an illness causing them to miss a year of work?

Finding a replacement for these types of prestigious occupations can be extremely difficult. Key Person insurance was designed to help soften that blow. When one of these income generators is unable to work, problems can immediately start to pile up. The business may start losing money. Owners may have to pay to recruit talent to keep their business going, let alone the cost of the new employee’s salary. Benefits from a Key Person policy can be used to offset all these costs.

Key Person insurance is similar to Individual Disability Insurance in that it replaces an individual’s income, but it designed to protect the owner of the business. The owner of the company will receive the benefit, whether or not they are the insured party. This is a great way for businesses to protect their investment in their top employees.

Loan Indemnification

If your client owns a business, especially if it opened in the last few years, chances are they will have plenty of business loan debt. If a disability keeps them out of work, the bank is still going to expect repayment of the loan. This is an extra burden that not everyone considers when planning their financial future.

The structure of a Bank Loan DI plan is fairly straightforward. In the event of a long term disability, the monthly benefit (usually equal to the loan payment amount) goes straight to the bank where the debt is owed. The best part is, the monthly benefit does not affect the issue limit for any of the other IDI products. With this product, your clients won’t have to use any of their Individual Disability benefit should an unfortunate situation arise. This is one of the best ways to protect a client’s standard of living.

Advantages of Selling to Business Owners

DI carriers are aware of the risks one takes when opening their own business, and they are willing to offer them rewards to compensate. In addition to huge sales opportunities, there are plenty of discounts and bonuses available to financially stable business owners. Many of the discounts can even be stacked! Here are the best ways to take full advantage of the benefits of selling DI to your self-employed clients:

Discounts/Upgrades:

- Business Owner Discount/Upgrades. All of our traditional carriers can offer discounted rates to owners of financially successful businesses (as long as they meet certain guidelines). Some offer a straightforward discount, while some offer a more favorable occupation class. Either way, the insured will be looking at a reduced premium

- Multiple Product Discounts. In some cases, your clients can receive an additional discount simply by taking out an IDI policy paired with one of the business products. We already established the need for all-around income and business protection, so why not save a little extra money in the process?

- Earned Income Enhancer. When determining the amount of income replacement available for self-employed applicants, carriers will go based off of their net income as opposed to the gross. As a way of offsetting a lower income figure due to tax write-offs, carriers can offer an increased benefit amount (usually around 20%). This can go a long way in protecting your client’s lifestyle

Don’t Forget:

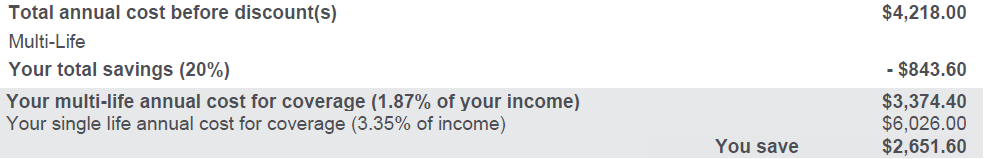

If your client’s business has at least 3 employees, there will be plenty of opportunities to add yet another discount. Carriers will offer up to 20% off (and sometimes with gender neutral rates) on three employees of the same company. Owners can sometimes save thousands of dollars in multi-life discounts, just by purchasing small DI plans for others in their company. Here is an example:

This female business owner would save about 44% on her policy by adding 2 more lives from her company! Even if she paid for the plans, and they were each $500, she would still be saving about $1,600, and giving some coverage to her employees. A true win-win situation.

Business owners present some of the best DI sales opportunities. For medium to larger companies, Guaranteed Standard Issue may also be an option. Contact us to learn more on how you may be able to help offer deeply-discounted policies with no medical underwriting! Also, download our business owners income protection checklist.