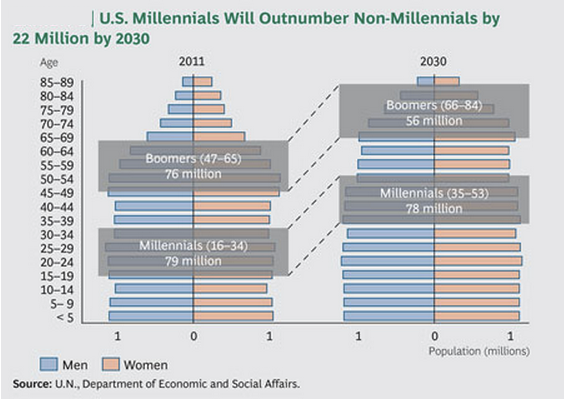

Until now, no generation has impacted society, economy, and commerce more than the baby boomers. Then the millennials arrived. Millennials, also called Gen Y, are born between 1980 and 2000. Today, the oldest is 35 and the youngest is 15. At the height of their influence, there were 76 million boomers. In 2030, there will be 78 million millennials. In only 15 years, millennials will reach the prime age range for buying insurance products.

A sure thing for insurance professionals?

The growth of this demographic paints a promising future for insurance professionals. For many of us, boomers fueled the growth of our practices. Is it reasonable to expect that the millennial market will result in a similar growth for the insurance industry?

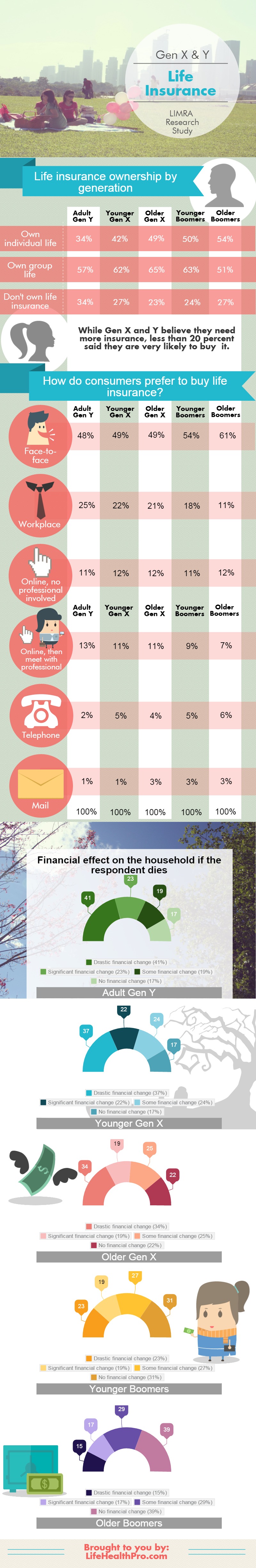

LIMRA (Life Insurance Management and Research Association) recently published research about millennials and insurance that LifeHealthPro illustrated in the infographic shown below. The data says we have our work cut out for us.

When it comes to life insurance, millennials hold historically low levels of ownership. In fact, only 34 percent of Gen Y adults own individual life insurance. Group life insurance ownership is also lowest among millennials. Even more alarming is that only 20 percent of millennials plan to purchase insurance. Although this data is specifically about life insurance, disability insurance ownership likely follows a similar trend.

Using the data to better understand the client.

This lack of enthusiasm for insurance products is not due to a lack of awareness or unrealistic expectations of the future. Forty-one percent of millennials believe that losing the primary wage earner’s income would have a drastic financial impact on the household. Your typical income protection insurance conversation starter may be about the financial stress that comes with an injury or illness. This generation may already be aware of the strain on their finances. What they may be unaware of are the products that can reduce or eliminate financial disaster.

When it comes to purchasing financial products, 48 percent of millennials want to buy insurance from a person in a face-to-face situation. Surprising, right? We also know that millennials rely heavily on the guidance and advice received from parents and friends. Use this powerful information to connect with children of your current clients. Millennials strongly prefer to work with professionals they know and trust. Ask your boomer clients to refer their Gen Y children to you.

More challenges ahead.

Other LIMRA research tells us that clients of all generations get stuck before reaching the end of the insurance buying process. Indecision is often due to the complexity of the products and the insider’s language we use to describe their features and benefits. Check out our article, How to facilitate more effective income protection conversations, about words that work with prospects when talking about disability insurance.

When you’re ready to present income protection to a new millennial client, call us for policy design guidance, sales tools and disability insurance quotes.