What do we know or think we know about millennials? Several organizations from Pew Research Center to Harvard University continue to study the phenomenon of generational cohorts assigning attributes, behaviors, economic impacts, and more to each. Most recently, Pew redefined the birth years for millennials to those born between 1981 and 1996. Today’s millennials are between 22 and 37 years old, with the older end being at the threshold for important insurance decisions and financial planning.

What do we know or think we know about millennials? Several organizations from Pew Research Center to Harvard University continue to study the phenomenon of generational cohorts assigning attributes, behaviors, economic impacts, and more to each. Most recently, Pew redefined the birth years for millennials to those born between 1981 and 1996. Today’s millennials are between 22 and 37 years old, with the older end being at the threshold for important insurance decisions and financial planning.

For advisors who built successful practices dominated by boomers, assumptions about clients and their needs may need a refresh. A better understanding of the challenges of today’s young adults will help advisors reassess their insurance marketing strategies to connect with the largest generation in the workforce.

How Do Millennials Differ from Boomers?

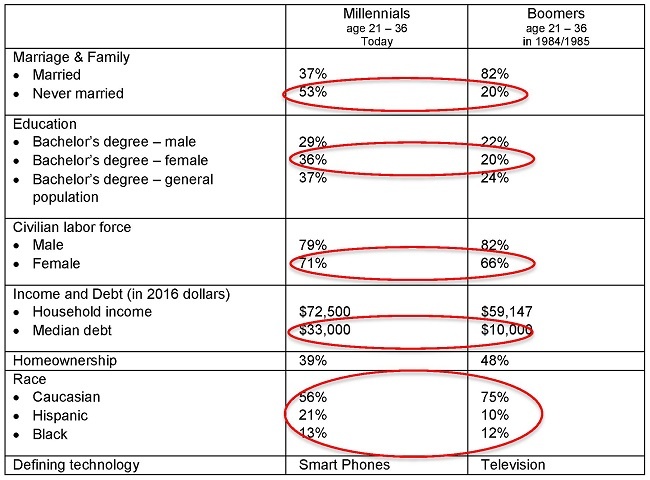

Let’s look at the experiences and impacts that shape and define boomers and millennials at similar points in life*.

* Age groupings vary between 21 – 36 and 25 – 34 depending on source.

The data shows four areas of significant differences:

- Marital status: Millennials are postponing marriage early on, but by the time the age group reaches 45, demographers expect millennials to look much like boomers did at the same age. An interesting cultural shift is the milestones that represent adulthood. For boomers, establishing a household and family were outward signs of becoming an adult. For millennials, earning a degree and achieving financial independence and the means to support a family are the markers of an adult. The traditional path of getting married, having children, buying a home are important but secondary.

- Growing prominence of women in the workforce: Advisors who have not embraced the female market are falling behind. Women hold tremendous financial power today and are a large part of the professional workforce. The older female millennial is a prime prospect for individual disability insurance. As a group, women have a greater probability (24%) compared to men (21%) of becoming disabled for three months or more.

- Shifting demographic: The complexion of the workforce and our society has changed. A good rule of thumb is to develop a client demographic mix that mirrors the community demographic mix.

- Debt: Both discretionary and non-discretionary spending patterns have changed. Student debt aside, this generation spends 145% more for education than the Boomers; 73% more for health care, 48% more for rental housing, and 29% more for pension and retirement savings. The trend of defined contribution retirement plans means individuals are responsible for a greater portion of retirement savings. A disability product that offers a student debt repayment feature or a plan that continues contributions to retirement accounts while disabled address some of the primary financial concerns.

Has your marketing approach kept up with the changes in the workforce? Millennials are now the largest segment of the labor force. Developing an understanding of the differences and similarities between millennials and boomers can provide the basis for your insurance marketing strategy. Call your DIS representative for a quote or to learn more about the new disability insurance products that are designed to serve this market.