Why did you go into the insurance business? For most of us, the reasons are similar, although ratios will vary:

- You like people and enjoy helping them

- You feel good knowing that what you do increases their peace of mind

- You want to earn a good living

Gaining new clients is a critical way to grow your insurance business, but don’t forget about the clients you already have. They already know you, trust you, and like your service. When they need complementary insurance products, most would rather (or at least wouldn’t be opposed to) get those from you.

For the same reasons that fast food companies ask if you’d like fries or a drink with your burger or chicken tenders, you want to ask each client whether they’d like some income protection along with their life or liability policy.

The Opportunities are There

Cross-selling opportunities are tremendous, regardless of the lines you are currently selling. While the numbers vary by line of business, here are some rough industry estimates to give you an idea of the potential market potential:

- Roughly 60% have only one policy with their agent

- Roughly 25% have two policies with their agent

- Roughly 10% have three or more policies with their agent

You may be resisting cross-selling for fear of coming across as pushy. The deeper your relationships with your clients, the easier it is to offer complementary products. Doing so creates more profound, holistic relationships that give you a robust understanding of their evolving needs, increase their faith in your ability to help them with their needs, lower your customer acquisition costs, and increase their lifetime value to you as a customer.

You Can’t Ignore the Numbers

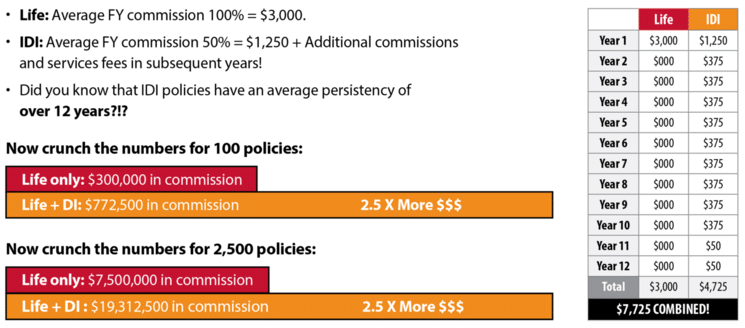

How would you like to turn a $3,000 commission into a $7,725 commission with hardly any extra effort? Add a straightforward question to your client conversation on each sale, and you can do just that. Ask each client whether they’d like some income protection along with their life policy.

By simply remembering to ask the question, here’s what can happen:

With one question, you just turned $3,000 into $7,725

Revenue AND Profit

Across all industries, insurance has the highest customer acquisition cost. The average insurance agency spends 7-9 times more to attract a new customer than to maintain an existing one.

Modern selling focuses on the customer experience. To win, you have to help your clients win too. Regular client interaction lets you uncover needs and respond with solutions to meet them.

That’s what cross-selling is all about—not being pushy, not being aggressive and simply providing superior customer service by offering more of what they need.

When customer retention increases by only 5%, profits increase by 25-95%, according to management consultant Bain & Company.

Younger Clients

Millennials (born between 1981 and 1996) are now the largest adult generation in the U.S., having recently passed Baby Boomers. You may think that between being so busy and feeling relatively immortal, these younger adults have such little interest in insurance that even the “add one question” effort isn’t worth it.

If so, you’d be wrong.

According to a Liberty Mutual and Safeco study, 80% of millennials with an agent for any policy want their agent to educate them. Contrary to the belief among many agents that millennials are not that interested, the study revealed that they want their agents to talk them through their coverage, explain what to expect if they have a claim, and help them discover unique features in their range.

Anyone with an income of $50,000 or more is a good candidate for income protection. According to the National Association of Colleges and Employers (NACE), the average salary for a new college graduate in 2021 was $55,260, a new record. The Census Bureau reports that the median millennial household earned $71,566 pre-tax in 2020.

Final Thoughts

Cross-selling adds value and delivers solutions to challenges that your clients face. At the same time, it can help you generate significantly more revenue without finding new clients. Cross-selling is unique because there’s more than one chance to close the deal. If the time isn’t right, you’ve at least planted a seed that you may be able to harvest at a later date.

The next time you write a new policy, remember French fries – and ask the question!

Download the SUPERSIZE handout to share with your team.

For more information on Individual Disability Insurance and help create the proper protection package for your clients, contact Disability Insurance Services at (800) 898-9641 or Request A Quote.