Have you ever heard someone say that income protection is the icing on the cake? This implies that disability insurance is a product to be enjoyed once other basic financial steps have been taken. However, this thinking is flawed. In reality, income protection is NOT the icing on the cake. Rather, it is the cake plate. It is the foundation that makes all other financial progress possible.

Disability Insurance is the Foundation for Financial Stability

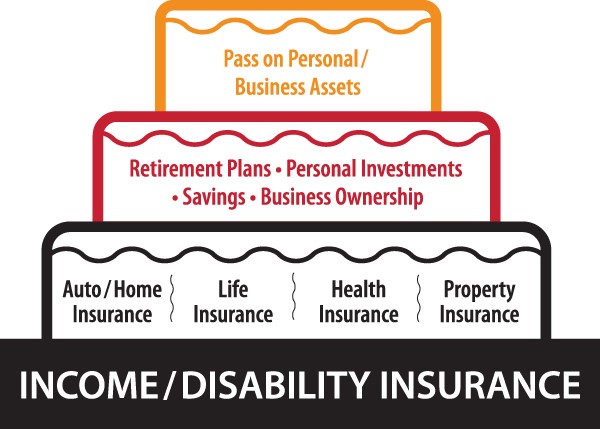

Financial stability can be likened to a multi-layered cake.

- Your health, life and property insurance policies form the bottom layer.

- Your savings, investments, retirement plans and business ownership form the middle layer.

- Your personal and business assets form the top layer.

If you think something is missing from this cake, you’re absolutely right. What’s missing is income. Income is the foundation that makes all other layers of financial stability possible.

For the Vast Majority, Income is Not Icing

A CareerBuilder survey found that 78 percent of U.S. workers live paycheck to paycheck. And it’s not only the minimum-wage earners who are struggling. Among people earning $100,000 or more, 9 percent live paycheck to paycheck and 59 percent are in debt. Among people earning between $50,000 and $99,999, 28 percent live paycheck to paycheck and 70 percent are in debt. In reality, most people depend on a regular paycheck. Unfortunately, a disability can prevent people from earning one.

How Quickly the Cake Crumbles

As we’ve already seen, the average person depends on their paycheck. Without it, the entire financial situation begins to crumble. This is why your income isn’t actually part of the financial stability cake. It’s the plate the cake sits on. It’s what keeps the cake from falling apart.

But if a person’s ability to earn a paycheck suddenly disappears, that person still needs a plate. This is where income protection comes in. Income alone is too fragile. It can be disrupted, or broken, by cancer, musculoskeletal problems, pregnancy complications and other forms of disability. To make a strong plate, you need to combine income with income protection.

Some people assume they can get this protection from Social Security. Unfortunately, it can take three months or longer to get a response, and only about a third of initial Social Security Disability Insurance claims are approved. Appeals are possible, but they require even more waiting. That’s a long time for your client’s cake to sit without a plate.

Your clients would be pretty mad if they ordered cake at a restaurant and had it delivered without a plate. We may take the plate for granted, but we need it. In the same way, we need income and income protection. Help your clients see that income protection is more than icing – it’s the foundation everything else rests on.

Let Your Clients Eat Cake

Income protection is not something extra that your clients can easily do without. In other words, DI is not the icing on the cake. Use this analogy to help your clients understand the importance of having a strong foundation of income protection. Need a great infographic to share with clients? Download our Modern Face of Disability Infographic!