Look through the many articles on the DIS Blog and you’ll find tips and tools to grow your long-term care insurance practice. You’ve got DIS to provide support and access to products. You’ve got the motivation to be successful. Product, sales tools, and motivation. What’s missing? Perhaps a clear picture of your target client. To help close this gap, we’ve compiled facts and statistics into an infographic describing your ideal long-term care insurance client.

Look through the many articles on the DIS Blog and you’ll find tips and tools to grow your long-term care insurance practice. You’ve got DIS to provide support and access to products. You’ve got the motivation to be successful. Product, sales tools, and motivation. What’s missing? Perhaps a clear picture of your target client. To help close this gap, we’ve compiled facts and statistics into an infographic describing your ideal long-term care insurance client.

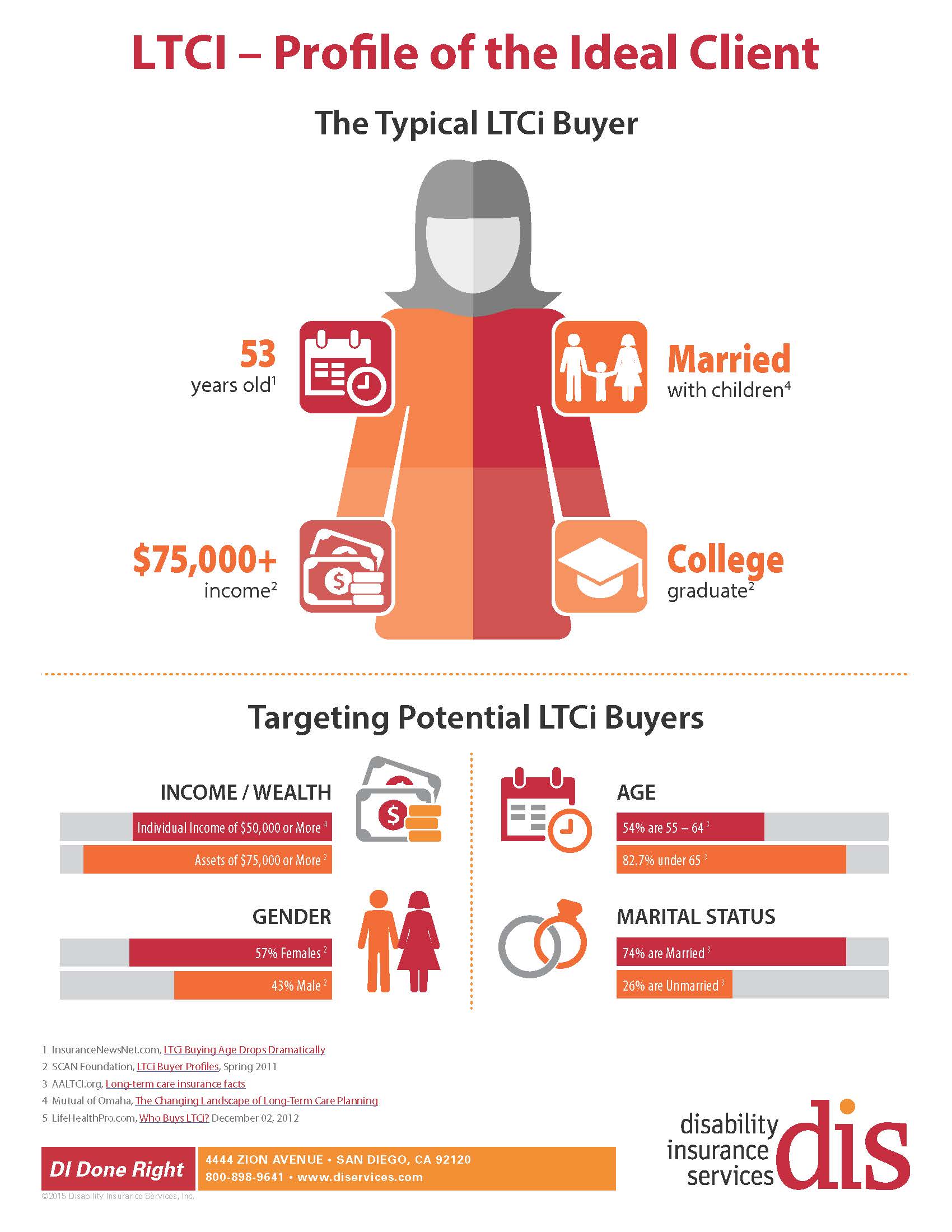

The average long-term care insurance buyer

Before examining the broader population of potential long-term care insurance buyers, let’s look at the characteristics of the typical buyer. She is 53 years old. The average long-term care insurance buyer is much younger than just five years ago when the average age was 59. Industry experts suspect the drop in age is due to LTCi worksite or multi-life sales and that as the sandwich generation cares for their aging parents and family members, they are more likely to buy long-term care insurance sooner that older generations.

She is married with adult children. She is strongly motivated to never become a burden for others. In fact, more than 70% of LTCi buyers cite that as one of their reasons to buy. She is also college educated and believes in the importance of being financially prepared.

The broader LTCi buying pool

Of course, the pool of long-term care buyers is much larger than the picture of the average LTCi buyer. We know, for instance, that it is quite common for married couples to each have a long-term care policy; accounting for the high percentage, 74%, of married long-term care insurance buyers.

More than 80% of LTCi buyers have incomes greater than $50,000. In fact, 57% have incomes of $75,000 or more. Financial protection of assets and against the cost of long-term care and are commonly given as reasons to say “yes” to long-term care insurance. You probably know several current clients with assets to protect that could benefit from a discussion about long-term care insurance.

Women hold more long-term care policies than men and its no surprise that more claims are paid on behalf of women. Because women have longer life spans, they are often caregivers to their spouses. If and when a woman needs long-term care, her spouse may not be there to care for her.

Studying the information in the infographic below might help you see some current clients that fit this profile. You might also think of groups in your community that fall into these demographics. As you turn these prospective LTCi leads into clients, contact us for long-term care insurance quotes and/or case design assistance. We’ll help you find the product, benefits, and carrier that best suit your clients’ needs.

Share this Image On Your Site