Why Supplemental Disability Insurance Makes Sense

If you have access to long term disability insurance through your job, you’re one of the lucky ones. Most workers don’t have this option. However, even if you have job-based disability insurance, you may not have as much coverage as you think. For many workers, it makes sense to secure supplemental disability insurance.

According to the U.S. Bureau of Labor Statistics (BLS), only 40% of civilian workers had access to short-term disability insurance through their job in 2020, and only 35% had access to long term disability insurance. Among those workers with access, the vast majority opted to enroll. Short term disability insurance had a take up rate of 98%.

This shows that many employees understand the importance of disability insurance. If a worker is unable to work because of a disability, the loss of income can be financially devastating, and this adds stress to an already difficult time. Disability insurance replaces a portion of the lost income. Short term disability coverage provides protection against temporary disabilities that last for under a year, while long term disability insurance provides coverage for disabilities that last for longer periods of time.

Any coverage is better than no coverage. However, many workers may not realize that their work-based disability insurance may not provide all the coverage they need. The good news is that is that it’s possible to own more than one disability insurance policy. By purchasing supplemental disability insurance, workers can secure the paycheck protection they need.

Why Supplemental Disability Insurance Makes Sense

If you have access to long term disability insurance through your job, you’re one of the lucky ones. Most workers don’t have this option. However, even if you have job-based disability insurance, you may not have as much coverage as you think. For many workers, it makes sense to secure supplemental disability insurance.

According to the U.S. Bureau of Labor Statistics (BLS), only 40% of civilian workers had access to short-term disability insurance through their job in 2020, and only 35% had access to long term disability insurance. Among those workers with access, the vast majority opted to enroll. Short term disability insurance had a take up rate of 98%.

This shows that many employees understand the importance of disability insurance. If a worker is unable to work because of a disability, the loss of income can be financially devastating, and this adds stress to an already difficult time. Disability insurance replaces a portion of the lost income. Short term disability coverage provides protection against temporary disabilities that last for under a year, while long term disability insurance provides coverage for disabilities that last for longer periods of time.

Any coverage is better than no coverage. However, many workers may not realize that their work-based disability insurance may not provide all the coverage they need. The good news is that is that it’s possible to own more than one disability insurance policy. By purchasing supplemental disability insurance, workers can secure the paycheck protection they need.

Filling in Gaps with Supplemental Disability Coverage

Disability insurance replaces a portion of a worker’s income. It does not replace the worker’s full compensation.

When you think about the possibility of fraud, this makes sense. If a worker could get their full income level through disability insurance payouts, there wouldn’t be much motivation to work. This could open the door to fraudulent and exaggerated claims.

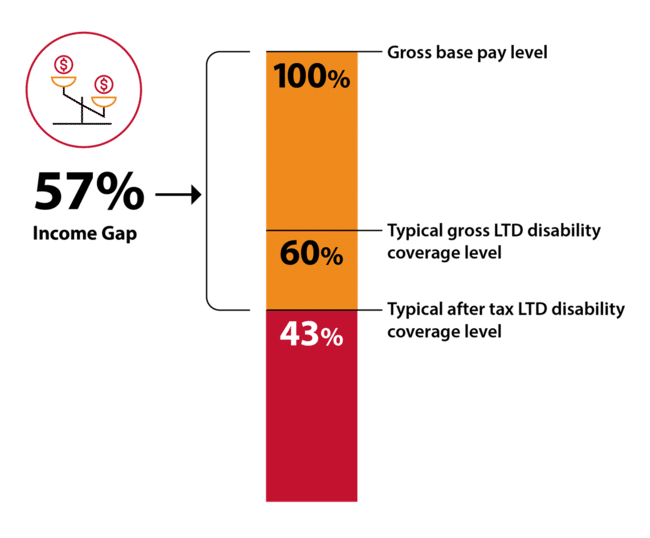

At the same time, for workers with legitimate claims, the reduction in pay can be a problem. A long term disability insurance plan offered through work typically only replaces 60% of a worker’s income – and that’s before taxes.

If a worker is used to earning $100,000 in gross pay a year, during a period of disability, they might have to scrape by on $43,000 after taxes. That’s going to require a major lifestyle adjustment, even before you factor in the medical costs that normal accompany a disability. Any savings that the worker has saved can be drained fast.

The situation can be even worse for high income earnings because monthly benefit caps limit the amount a policyholder can receive. The higher the income, the bigger the disability insurance coverage gap.

Download the Income Gap Handout today!

Portable Disability Income Insurance

Another issue with work-based long term disability insurance is that it usually isn’t portable. If you leave your job, you can lose your coverage.

This can be a bigger deal than workers realize.

Underwriting Considerations. You might think that if you lose your insurance policy you can just buy a new insurance policy at that point, so there’s no reason to worry about it ahead of time. Not so fast. This might be true when it comes to health insurance – under the ACA, health insurers cannot deny coverage or charge higher rates due to pre-existing conditions – but disability insurance is different. A disability insurance company absolutely can decide to deny coverage or charge higher rates based on the worker’s age or health conditions.

Let’s say a worker is 30 years old and in great health. He gets long term disability insurance through his job, and he doesn’t buy additional coverage. He works at the same company for 20 years. During that time, he’s diagnosed with diabetes, hypertension and heart disease. Then when he’s 50, he decides to take a new position at a different company. He loses his disability insurance, and his new job doesn’t offer the benefit. He tries to buy individual disability insurance coverage on his own, but because of his health conditions, most insurers reject his application, and the ones that offer coverage want to charge higher rates than he can afford.

Job Considerations. Job-based group long term disability insurance can be great in a lot of ways. If an employer is offering it at little to no cost, there’s probably no reason not to accept coverage. However, there are drawbacks, and the lack of portability is a big one.

Most workers just don’t stay at one job for their entire working lives. According to BLS, the average person has 12.4 jobs between the ages of 18 and 24. That’s a lot of job hunting. Additionally, many workers are deciding to leave traditional employment entirely in favor of freelance work. Although this decision can result in many advantages, it means saying goodbye to employee benefits.

By purchasing individual supplemental coverage on their own, workers can obtain coverage that they can take with them when they change jobs.

Get the Terms You Need

Another drawback to group long term disability coverage is that it’s not customized to your needs.

Disability insurance policies can vary widely. The group policy people get from work might not have the terms that meet their needs. When looking at a supplemental disability insurance policy, here are some issues to consider:

- The definition of disability. Some policies use a strict any-occupation definition, while others use an own-occupation definition that focuses on whether the individual can perform the job they’re accustomed to.

- The elimination period. This is how long the policyholder will have to wait after a disability before receiving benefits. A shorter elimination period means the policyholder can start collecting benefits sooner.

- The benefit period. This is how long the policy can continue to pay out benefits. Some disabilities exist for years, and others are permanent, so a long benefit period is ideal.

- Riders. Many disability insurance companies offer riders that can provide additional benefits and options.

Supplemental Disability Insurance Delivers a Great Value

Many people balk at the prospect of buying disability because they don’t want to spend a lot of money on a coverage they don’t think they’ll ever need, but this view is based on a couple of misconceptions.

First of all, disability is incredibly common. The Social Security Administration says that one in four 20-year-olds will experience a disability before reaching retirement age. A working-age individual is more likely to experience disability than death, so it doesn’t make sense to buy life insurance buy not disability insurance.

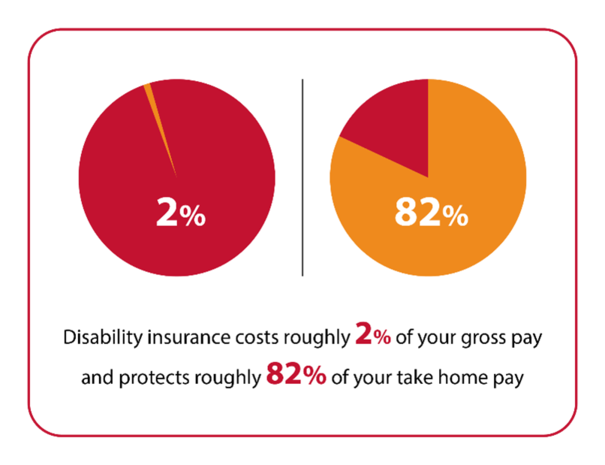

Second, disability insurance isn’t actually that expensive when you look at the value you get. An individual disability insurance policy usually costs around 2% of your gross pay, and it can protect around 82% of your take home pay.

Your paycheck is likely your biggest asset. Over the course of your career, it’s worth more than your car and probably even more than your house. Workers should keep that value in mind when looking at premium costs.

Most workers depend on their paycheck. Protecting that paycheck with supplemental disability insurance is an essential part of creating a financially stable future.

Learn more about supplemental disability insurance. Download the income gap handout and request a quote.